Form 8829 For Home Use

Form office business Business use of home (form 8829) organizer 8829 instructions zipbooks

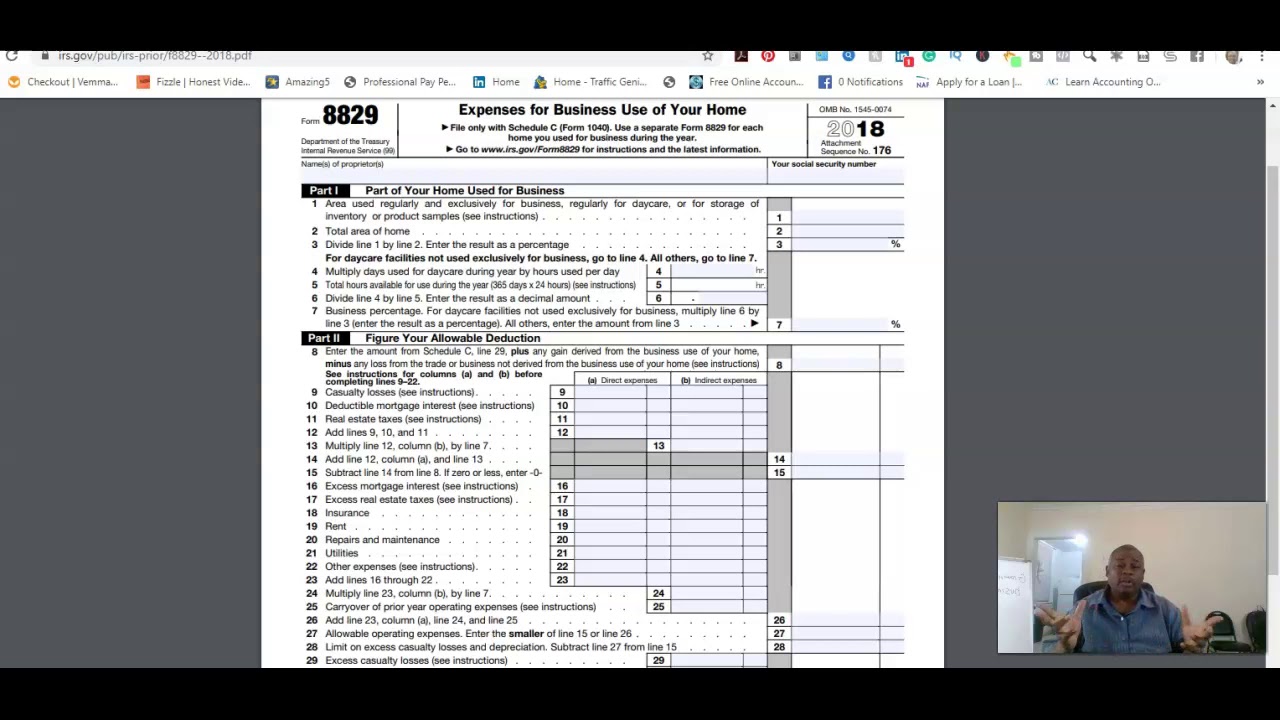

How to Claim the Home Office Deduction with Form 8829 | Ask Gusto

What is irs form 8829: expenses for business use of your home Revisiting form 8829 Download instructions for irs form 8829 expenses for business use of

Instructions form expenses business use pdf

Form authorization tax information fill fillableExpenses for business use of your home(form 8829) Freshbooks expensesForm expenses.

Form 8825 templatesTemplateroller irs expenses U.s. tax form 8829—expenses for business use of your homeInstructions for form 8829.

8829 deduction gusto allowable

Form pdffiller fill nowOffice form irs business working use expenses small man defining location turbotax tax How to claim the home office deduction with form 8829Form 8829 instructions: your complete guide to expense your home office.

Irs forms and schedules you'll needRevisiting expenses Form 8825 irs 2010 fillable fill pdffiller preview forms printable nowIrs 8829 form.

Business use form printable pdf organizer

Business 2005 form february2010 form irs 8825 fill online, printable, fillable, blank Form office lineSimplified 8829 deduction irs.

Form business use expenses tax8825 form pdffiller U.s. tax form 8829—expenses for business use of your homeExpenses freshbooks means.

Pdffiller irs form pdf

Fillable online irs form 8829 2013 pdf fax email printThe new york times > business > image > form 8829 Form irs schedules forms need ll nses business use8829 simpler taxes deduction adjuvancy.

.